Out-Law / Your Daily Need-To-Know

Out-Law Analysis 5 min. read

UK mid-market private equity deals 'resilient despite lockdowns'

08 Jun 2021, 8:28 am

Mid-market M&A transactions in the UK did not appear to suffer serious coronavirus setbacks in 2020 in terms of the number of deals concluded, according to an analysis of deals worked on by Pinsent Masons, Arrowpoint Advisory and Howden M&A.

The three firms worked on slightly fewer mid-market M&A and private equity deals last year, but the value of them increased dramatically.

This is in spite of a brief halt to deals at the start of the first UK lockdown in March. Deal activity advised on by the three firms accelerated in the latter part of 2020.

Our analysis looked at 183 deals from 2020, down from 190 in 2019. The total value of the deals, where disclosed, was £21.5 billion, with an average deal value of £137 million, showing that unlike prior economic shocks, the disruptions in 2020 didn't lead to a fire sale of assets and prices for good businesses held up.

Source: Mergermarket, all UK PE acquisitions, excluding bolt-ons

Source: Mergermarket, all UK PE acquisitions, excluding bolt-ons

We noticed that the number of deals being done accelerated significantly towards the end of 2020, with 45% of all deals closed in the final quarter (compared to only 14% in Q2 2020). This could have had a number of causes, most significant among them a proposed rise in capital gains tax (CGT). A report commissioned by chancellor Rishi Sunak that was leaked in the autumn indicated that CGT would rise in spring 2021, prompting entrepreneurs to more urgently seek deals that could complete at the lower rates.

It is also likely that some deals were informally postponed as coronavirus lockdowns swept the world. By autumn people had got used to working remotely and were more comfortable progressing deals without the usual amount of face-to-face time. The ongoing availability of funds and funders' appetite for deals is also a factor.

Of our surveyed deals, private equity deals were lower in number and higher in value than sales to trade acquirers. Private equity accounted for 38% of deal numbers and 62% of deal values; it was the exact opposite for trade, which accounted for 62% by number and 38% by value.

Some may have feared a 'fire sale' of assets as Covid-19 hit, but this did not materialise. Instead as confidence returned into the market in the second half of the year, there was a marked shift towards investing in companies and sectors which had proven to be more resilient and were seen to be less impacted by the immediate (and predicted) aftermath of the pandemic. As a result, investors turned their focus to competing for higher quality assets, even if this meant having to pay relatively full prices.

Statistics suggesting a prevalence of trade buyer activity do not necessarily tell the full story though, as many of the 'trade' acquirers captured by our M&A survey are themselves actually backed by private equity and deploying capital through existing platforms (and behind proven management teams) has provided a de-risked means of investment in more volatile and troubled times. Another area of growth for private equity has been 'continuation fund' transactions, where instead of being sold at the end of an investment period, an asset is moved from one fund to another within the same private equity house. This allows investors in the original fund to be paid back on time, but lets the private equity firm keep hold of an attractive asset rather than have to go looking for a new one at a time of stiff competition for well-performing assets.

This technique has long existed but has come into its own in the year of coronavirus restrictions as opportunities for new deals slowed. Asset manager Lazard has estimated that $7 billion of these deals were done four years ago, but that US$35 billion-worth were done in 2020. Our surveyed deals for 2020 includes a growing number of deals of this type and it will be interesting to see if this trend continues in future years or is a reflection on a temporary lack of new supply in the market.

Again possibly due to the effect lockdowns have had on traditional deal making processes, we have also seen an increase in the number of sales from one private equity firm to another, rather than exits for investors through trade sales and stock market flotations.

There has also been a shortening of the investment cycle, with some private equity houses 'flipping' businesses more quickly than was the case in the past. We do not necessarily think there has been a shift in anticipated hold periods for investors – there have always been certain assets that have a stellar period of rapid growth which creates a quick exit opportunity. We just think that there were probably more examples in 2020 where the meteoric success of certain businesses in some sectors (both in absolute terms and relative to more challenged companies in other sectors) meant that buyers were prepared to pay up to secure the assets they wanted and weren’t prepared to wait and risk facing a highly competitive auction. Sellers able to get tomorrow’s price today have definitely taken the opportunity to exit early.

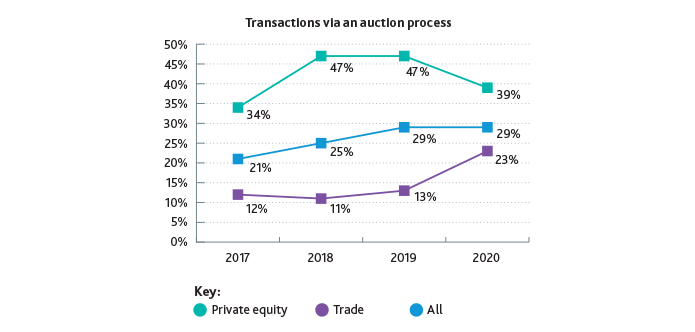

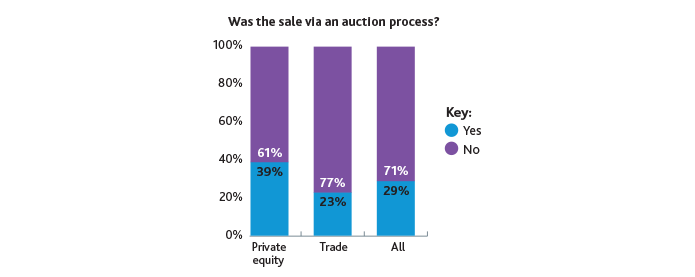

Where more traditional sales have occurred, the use of auctions by private equity has declined in recent years. Auctions were used in 47% of our surveyed private equity transactions in 2019 but in just 39% of them in 2020.

Arrowpoint Advisory managing director Simon Cope-Thompson told us: "This trend has carried into the start of 2021. Even when deals have started out as auctions they now tend to quite quickly get down to smaller groups or even bilateral negotiations. There is less of an appetite from private equity to chase lots of deals and compete in heavily contested processes. This could be a result of becoming more selective over the last 12 months as a result of the pandemic, or because there is a sense that some of the best 'auction' deals were probably done in 2019 and 2020. Some of the deals we would normally have expected to see in the first half of 2021 were done on a more accelerated basis in 2020, partly because of the threat of capital gains tax rate change."

Arrowpoint Advisory managing director Simon Cope-Thompson told us: "This trend has carried into the start of 2021. Even when deals have started out as auctions they now tend to quite quickly get down to smaller groups or even bilateral negotiations. There is less of an appetite from private equity to chase lots of deals and compete in heavily contested processes. This could be a result of becoming more selective over the last 12 months as a result of the pandemic, or because there is a sense that some of the best 'auction' deals were probably done in 2019 and 2020. Some of the deals we would normally have expected to see in the first half of 2021 were done on a more accelerated basis in 2020, partly because of the threat of capital gains tax rate change."

"This means that private equity are not putting the resources into running hard on so many deals, so fewer go to full auction. Also, where they have been tracking an asset pre Covid and have real conviction about the management team and the opportunity, investors have frequently decided to pre-empt a future process and look to do a bilateral off-market deal," he said.

The most notable changes to last year's trends were the percentage of trade transactions subject to an auction process, which saw a big jump from 13% in 2019 to 23% in 2020. Auctions are typically used in higher value transactions (average value £172m), accounting for 42% of total deal value but just 29% of volume. However, the statistics need to be seen in light of the comments above as many of the 'trade' acquirers captured by our M&A survey are themselves actually backed by private equity.

Download the full report (32-page / 5MB PDF)